Major VAT Improvements Are Coming to payPod

2025-07-22

What's Changing?

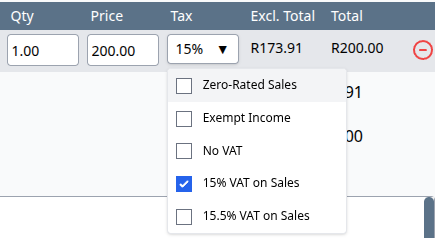

VAT selection on invoices and documents will now be a drop-down listing the various VAT codes (see below):

Here's a preview of the key improvements:

- Ability to add bills (supplier invoices) and track VAT on bill line items

This addition is necessary to track VAT for purchases. - VAT201 Reports that match SARS fields exactly

Easily generate VAT201 reports with the correct field numbers and tax breakdowns - ready for submission or reconciliation. - Support for a full range of VAT types

Including standard-rated, zero-rated, exempt, exported goods, imported services (reverse charge), second-hand goods, bad debt adjustments, and more. - Accrual-basis reporting

VAT is now reported based on the invoice and bill dates - not when payments are made - in line with how SARS expects businesses to report. - Expanded tax codes per line item

Apply precise tax codes to each invoice or bill line item, giving you full flexibility and accuracy. - Clearer separation of input and output VAT

Better tracking of what you owe SARS vs. what you can claim back - including support for capital and non-capital goods. - Import and export support

Correctly account for services or goods imported from or exported to other countries.

What This Means for You

This is a significant upgrade and will require a few changes to how you assign tax codes to invoices (and now bills). But the benefits are clear:

- Better compliance

- More accurate reporting

- Easier VAT filing

- Peace of mind

We’ll be publishing a full guide on how to use the new VAT tools, and we’re always here if you need help.

No Action Yet - But It’s Coming Soon

This new VAT system is in its final testing phase and will be rolled out in the coming weeks.

For now, please review the new resources page for this new feature.

Thanks again for using payPod. These improvements are an important step forward, and we're confident they’ll make your life easier, your books cleaner, and your business stronger.

- The payPod Team