Accounting Software built for You

If you can't get your head around endless accounting jargon, and simply need to track your money, we're here to help.

payPod provides accounting software built for solo-preneurs and small business owners. We've removed the technical barrier to tracking your finances and generating financial reports by focusing our software on the most common day-to-day tasks: income, and expenses.

While simplified, payPod is still double-entry, meaning Income Statements and Balance sheets can be generated at the click of a button.

Some of Our Features

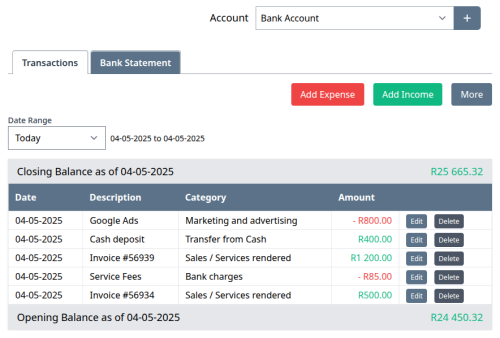

Transactions

Track transactions for all of your bank and credit accounts. This is double-entry accounting, with less fuss.

Income Statements

Also called a Profit & Loss report, the income statement is an essential report to track your money.

Balance Sheets

Our Balance Sheet can be generated in seconds and give you snapshot of your business finances for a given day.

Chart of Accounts

Essentially a list of your bank accounts, credit accounts and income + expense categories.

VAT Report

If you are VAT registered, the VAT 201 report is crucial for tracking what you owe SARS.

Invoicing

A simple yet intuitive interface for creating invoices in just a few minutes. Includes optional tax and discount calculations.

Quotations

Create quotes with ease and convert them into invoices seamlessly when your client accepts your offer.

Bank Statement Import

Import & Reconcile .OFX or .CSV export files from your internet banking.

Our Pricing

First month of Premium is FREE. No contracts. Cancel any time.

Pay yearly and get 3 months free!