An accounting transaction is any event that affects a business's financial records, like selling a product, buying supplies, or receiving payment. It involves money or assets changing hands and is recorded to keep track of the company's finances.

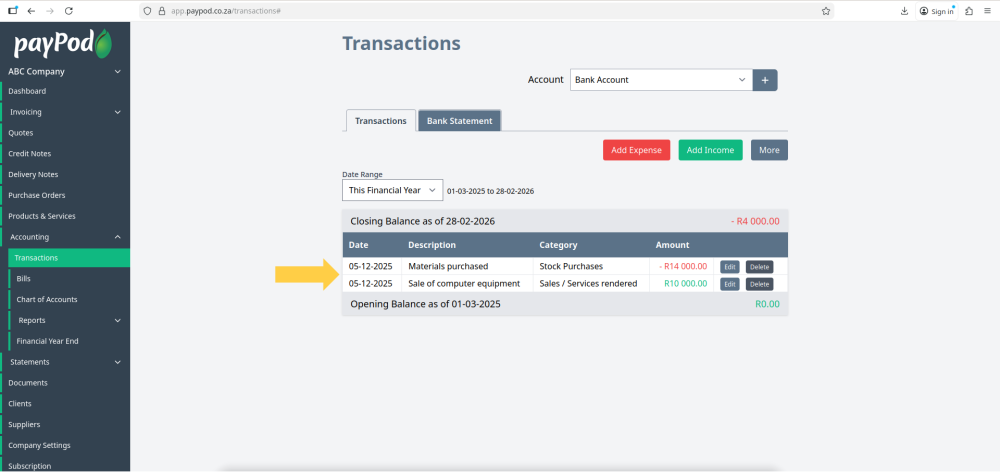

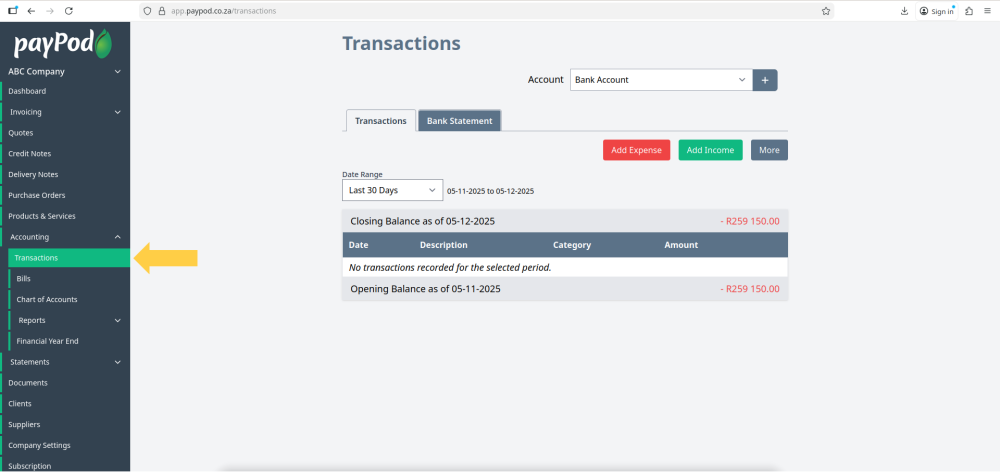

Navigating to Transactions

Click on the transactions tab under the accounting dropdown on the sidebar.

This is where users can view, manage, and track all financial activity recorded. It provides a centralized list of payments, receipts, and other transaction entries.

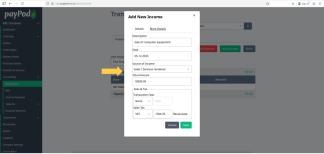

Record Income (e.g. payment for an invoice)

- Navigate to Accounting > Transactions.

- Select the correct bank, cash, or credit account from the ** account drop-down** (important!). This is the account that the money was paid to.

- Click the Add Income. A pop-up will open.

- Fill in a description, select the exact date the transaction happened, and choose a suitable Source of Income.

- Capture the total amount that landed in your account.

- Ignore the VAT drop-down if you are not VAT registered.

- Click Save. The pop-up will close and the transaction list will update.

The pop-up has a second tab titled "More Details". Click this to see additional fields that allow you to assign the payment to an invoice or client. You can also attach a document.

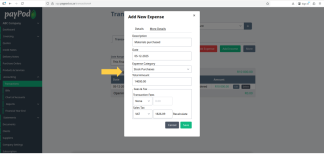

Record an Expense (e.g. buying petrol)

- Navigate to Accounting > Transactions.

- Select the correct bank, cash, or credit account from the account drop-down (important!). This is the account that the money was paid to.

- Click the Add Expense. A pop-up will open.

- Fill in a description, select the exact date the transaction happened, and choose a suitable Expense Category.

- Capture the total amount that was paid from your account.

- Ignore the VAT drop-down if you are not VAT registered.

- Click Save. The pop-up will close and the transaction list will update.

You can also use the income and expense pop-ups to transfer money between your accounts, such as when you pay off your credit card.

Record a Journal Transaction (requires accounting knowledge)

While the income and expense pop-up input is stored as a Journal Entry, payPod provides them as a way to easily capture common transactions for business owners, without worrying about 'debits' and 'credits'.

- Navigate to Accounting > Transactions.

- Select the correct bank, cash, or credit account from the account drop-down (important!). This is the account that the money was paid to.

- Click the More, then select Add Journal Entry. A pop-up will open.

- Fill in a description, and capture the transaction details. The form will not allow you to save unless the total debits equal the total credits.

- Click Save once satisfied. The pop-up will close and the transaction list will update.

Edit a Transaction

You can edit or delete transactions using the buttons to the right of the transaction.