If you started your business recently and only have a few month of transactions in your bank account, we recommend importing your full transaction history instead.

Who this is for

- For small or micro businesses with no previous accounting records that are just starting to use accounting software.

- Businesses that do not have a breakdown of how the business got to that point (i.e., prior income, expenses, or owner equity contributions).

- You don't have the full transaction history available.

What Is an Opening Balance?

An opening balance is the starting amount in an account when you begin using payPod for your accounting. You’ll set these manually using journal entries, so your reports and balances reflect reality from day one.

Step-by-Step: Entering Opening Balances Manually

Step 1: Choose a Start Date

Pick a cutoff/start date—usually the start of a month or year (e.g. Jan 1, 2025). All balances should reflect the values as of this date.

Step 2: Create the Necessary Accounts

Navigate to Accounting > Chart of Accounts and make sure you have these:

Asset Accounts: Bank Account (Type: Cash & Bank)

Liability Accounts: Credit Card Account (Type: Credit Cards & Loan Accounts)

Equity Account: Opening Balances Equity (Type: Opening Balance Equity)

This "Opening Balances Equity" account acts as the offset for all opening balances.

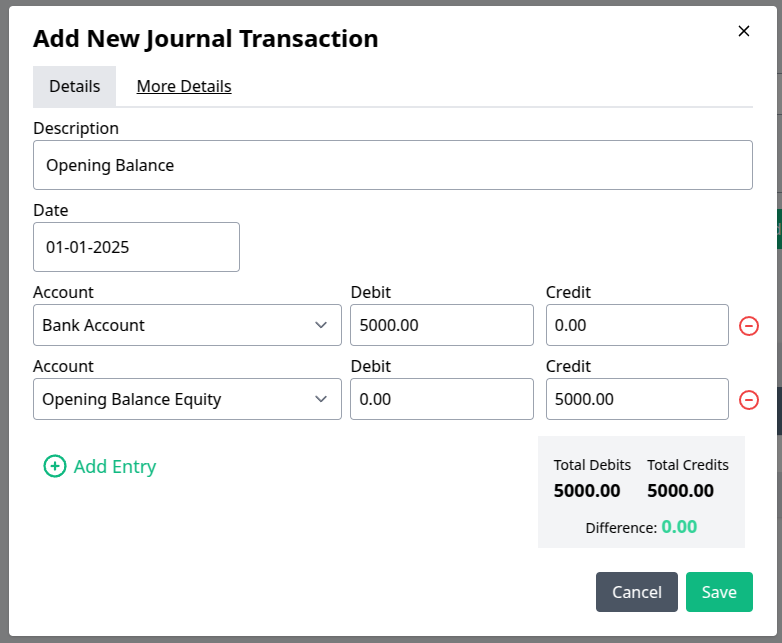

Step 3: Record a Journal Entry for the Bank Account

Let’s say your bank balance as of Jan 1, 2025 is R5000.

- Navigate to the Transactions page under Accounting.

- Select the bank account from the dropdown.

- Next click the More button and select Add Journal Entry.

- Fill in the below Journal Entry, then click Save.

Here you are debiting the the Bank Account by the positive balance on your bank statement, and crediting the Opening Balance Account.

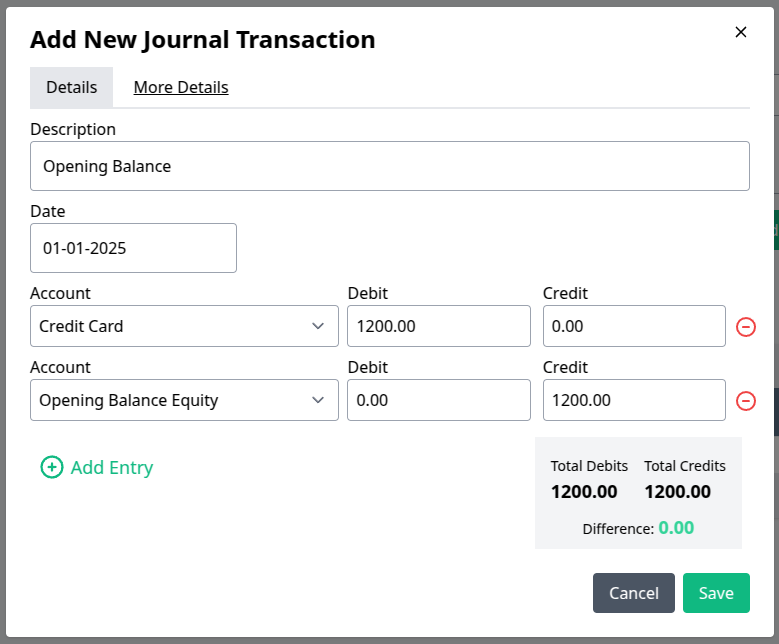

Step 4: Record a Journal Entry for the Credit Card (if you have one)

Let’s say you owe R1200 on your business credit card as of Jan 1.

- Select the bank account from the dropdown.

- Much like Step 3, we will create the following Journal Entry:

Credit the liability account (what you owe). Debit the equity account to balance.

Step 5: Check Your Work

Navigate to Accounting > Balance Sheet.

Confirm that the following balances reflect:

- Bank Account shows $5,000 (asset).

- Credit Card Account shows $1,200 (liability).

- Opening Balances Equity shows $3,800 (net worth).

Common Pitfalls

- Forgetting to create the Opening Balances Equity account.

- Debiting and crediting the wrong way around.

- Using today’s balance instead of the chosen start date.

- Not double-checking that the journal entry totals match (debits = credits).

Next Steps

Once you have your opening balance, you can start adding transactions starting after the opening balance date: How to Import & Reconcile a Bank Statement in payPod