This page allows you to view, create and edit all of your accounts. This includes your physical bank accounts and expense/income categories.

The Chart of Accounts are divided into the standard accounting account types, which will be explained shortly:

- Assets

- Liabilities

- Income

- Expense

- Equity

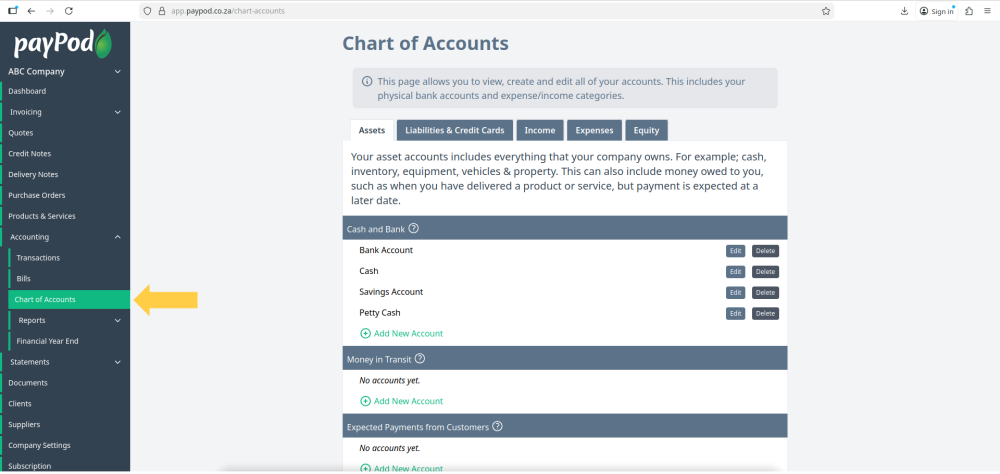

Navigating to Chart of Accounts

Click on the chart of accounts tab under the accounting dropdown on the sidebar.

Sections

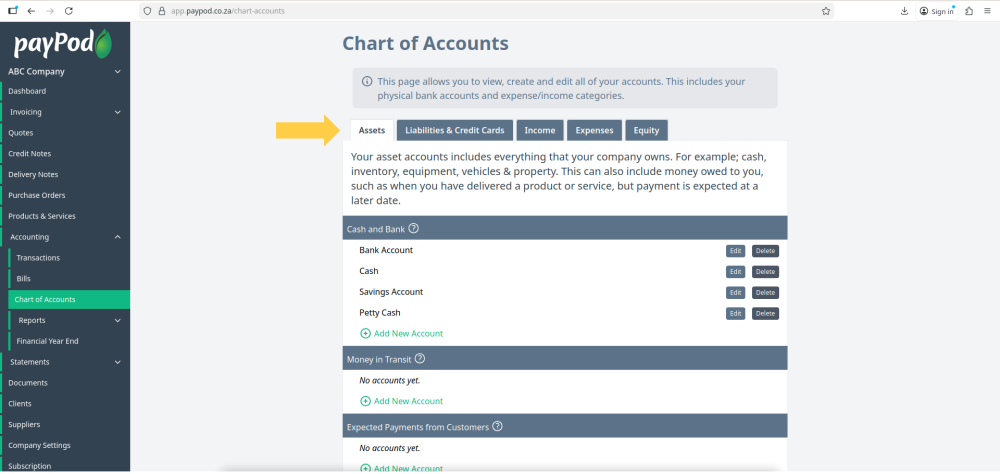

Below is a description of each account type, available as tabs across the top.

Each of the below account types are further divided into "Sub-types". Hover over or tap the "?" icon next to each heading on the Chart of Accounts page to see a more detailed description.

Assets

Your asset accounts includes everything that your company owns. For example; cash, inventory, equipment, vehicles & property. This can also include money owed to you, such as when you have delivered a product or service, but payment is expected at a later date.

Liabilities

Liabilities include the debts or obligations payable to creditors and other outsiders to which your company owes money. These can be loans, unpaid utility bills, bank overdrafts, car loans, mortgages and more.

Income

Revenue, one of the primary types of accounts in accounting, includes the money your company earns from selling goods and services. This term is also used to denote dividends and interest resulting from marketable securities.

Expenses

Any product or service that your company purchases to generate income or manufacture goods is considered an expense. This may include advertising costs, utilities, rent, salaries and others. Some expenses are deductible and help reduce your taxable income.

Equity

The equity account defines how much your business is currently worth. It's the residual interest in your company's assets after deducting liabilities. Common stock, dividends and retained earnings are all examples of equity.

Don't get overwhelmed! If you're new to accounting, this can be confusing. Have patience and seek online resources -

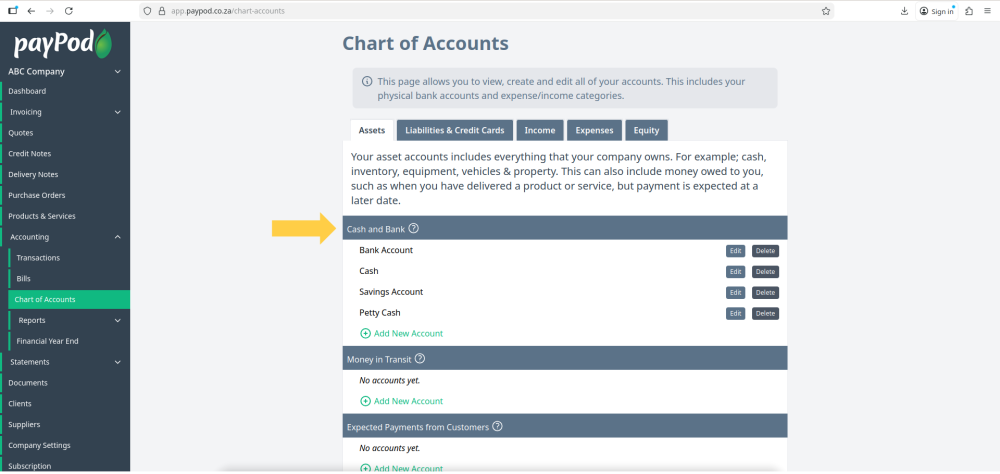

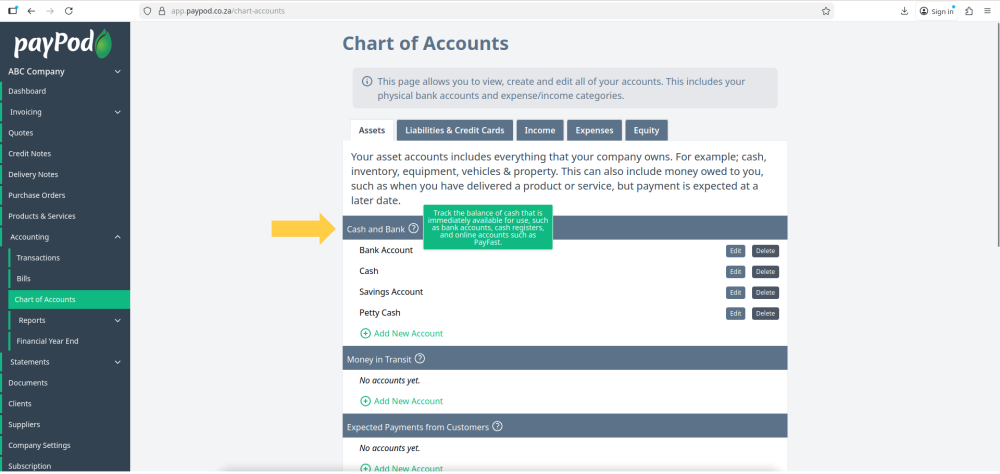

The accounts are then grouped by sub categories:

Hover over the question mark on a sub category to view a description of what accounts belong under this category.

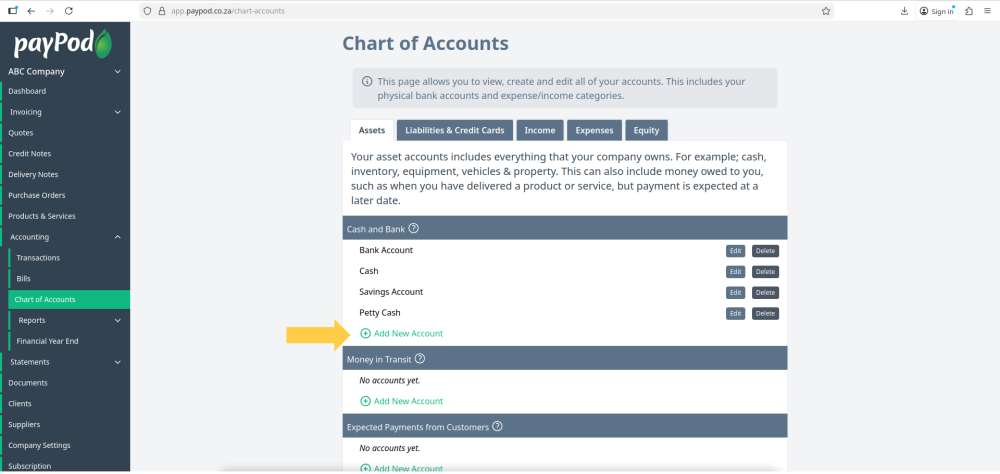

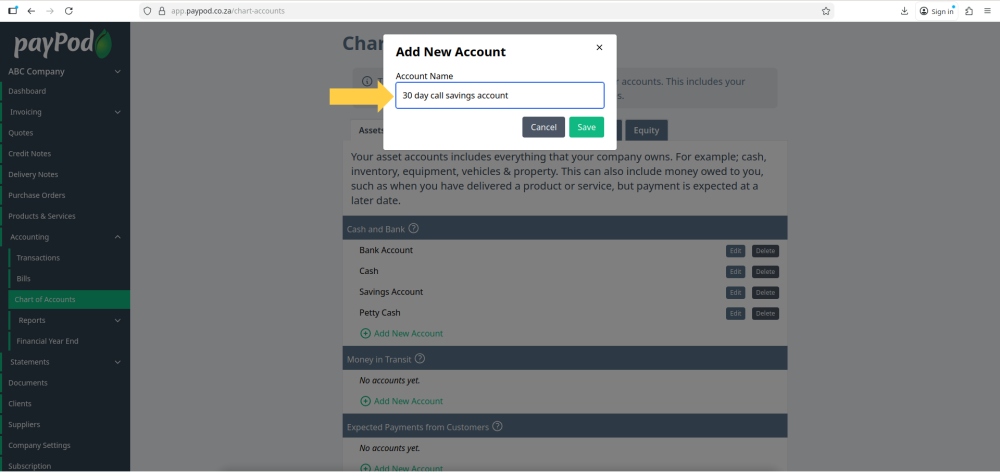

Creating an Account (if account doesn't already exist)

To add an account to a sub category click the add new account button.

Enter the name of the account and click save to add the account.

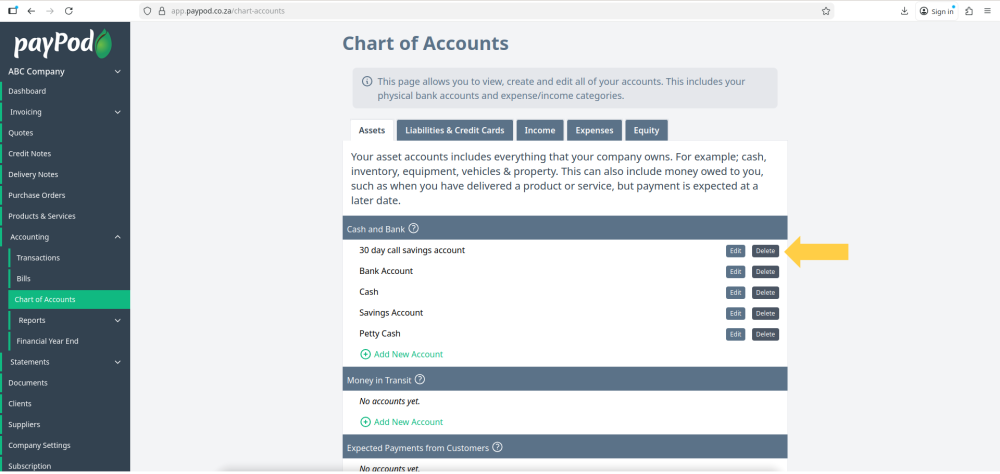

Edit or Delete Accounts

You can edit or delete an account by using the buttons to the right of an account name.